Calculate Now

Estimate your R&D tax opportunity. Please provide the information below to get started.

The research and development (R&D) tax credit is a powerful resource that can help you significantly reduce your tax burden, generate cash flow, and grow your business operations. Current legislation allows over 40 industries to tap into the benefits offered by the R&D tax credit, making it an invaluable option for companies of every size and scope. From startups to Fortune 500 enterprises (and a wide range of everything in between), every eligible R&D tax credit deduction drives an influx of capital that can be invested back into the business, giving a company the competitive edge it needs to outperform other industry leaders.

Unfortunately, many business owners miss out on this invaluable opportunity to lower federal and state taxable income on a dollar-for-dollar basis simply because they don't realize their R&D tax credits, ultimately leaving unclaimed money on the table. An organization may be eligible for a research tax credit if operations meet the requirements of a standardized 4-part test that:

Eliminates technical uncertainty

Includes process of experimentation

Technological in nature (engineering sciences, physical sciences, computer sciences, biological sciences)

Qualified purpose (product, process, technique, formula, invention, software)

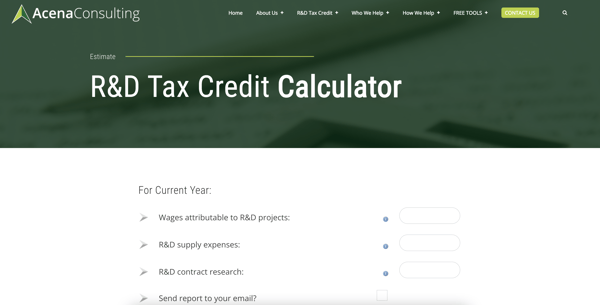

If you have questions about research tax credit potential, Acena Consulting's credit calculator can help. Acena Consulting's R&D Tax Credit Calculator helps CPAs and business owners estimate potential research and development tax credits. Our digital calculator guides you through each section, offering useful information on needed input to help establish a baseline of qualification. There's even an option to export the calculations into a PDF to be sent to your email for further review. Whether you're a CPA firm helping a client navigate through the R&D process or a business owner curious about your own operations, our easy-to-use, complimentary tax credit calculator provides a starting point to begin finding answers about a company's possible deduction qualifications.

It's important to note, Acena Consulting's online R&D calculator is only an estimate based on statistical data relating to industry, location, and other general factors. The only way to gauge a company's actual deduction amount is to partner with a team of experienced tax professionals.

Don't wait — you may have several credits waiting to be claimed. Acena Consulting helps business owners and their CPA firms establish program qualifications for maximum deduction benefits. Contact Acena Consulting today to discuss your research deduction questions with one of our highly skilled and innovative tax advisors.

Estimate your R&D tax opportunity. Please provide the information below to get started.

Acena is your expert research and development tax credit partner. We help CPAs, business owners, and accounting and finance professionals evaluate and qualify innovation projects to maximize the Section 41 R&D tax credit.

info@acenaconsulting.com | (805) 426-9669 | 340 N Westlake Blvd, Westlake Village, CA

Copyright © 2026 Acena Consulting | Made with ♥ by Orange Pegs