Optimize Local Tax Credits

R&D Tax Credits by State

Leverage local legislation to minimize final tax burden and drive overall profit margins

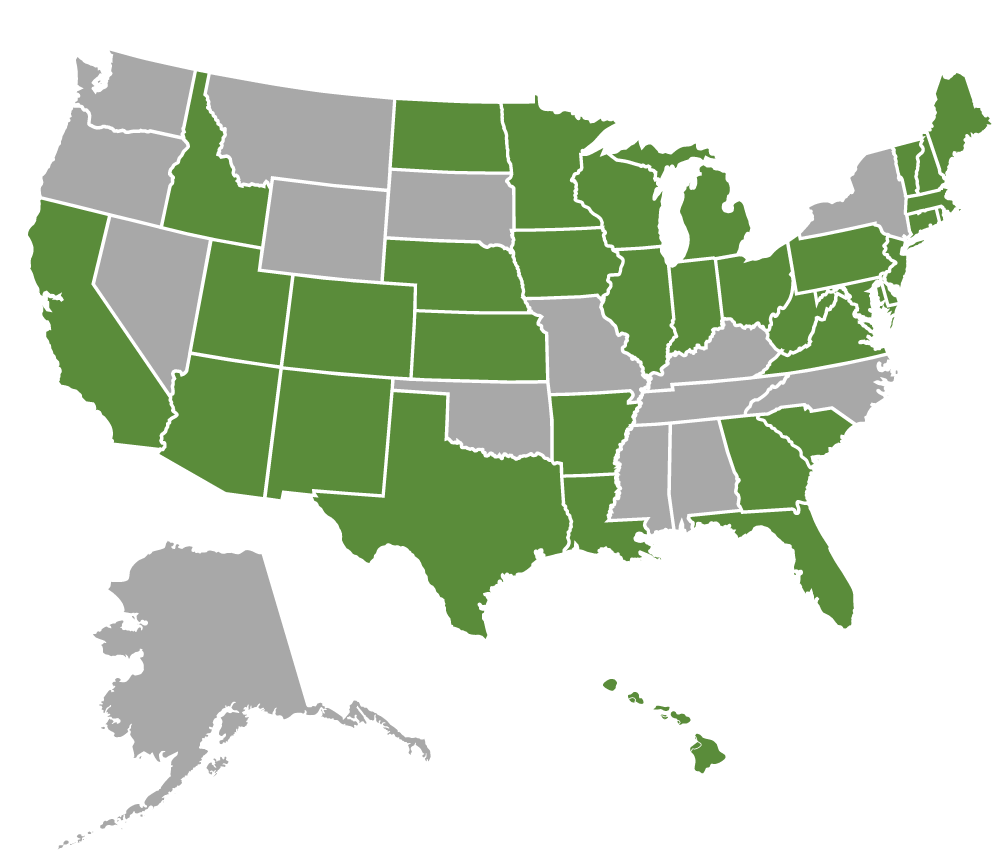

Does Your State Participate?

The majority of U.S. states offer the R&D tax credit to help local business owners:

Increase Capital

Identify opportunities to leverage R&D activities to capture additional capital

Grow Operations

Use the benefit to reinvest into your company and scale your business footprint

Create New Jobs

Generate new professional positions as your business expands

State-by-State Guide

Download this free resource to identify cost-saving opportunities in your state

How Acena Consulting Helps

We partner with business owners, CPAs, and financial advisors to analyze state tax credit components, including:

Business Eligibility

Each state offers different business eligibility requirements to claim the R&D tax credit

Credit Percentages

We'll drill down on the total credit percentages you're entitled to based on your business location

Proper Documentation

Acena Consulting's tax professionals will help develop complete documentation to support your R&D tax claims

Exceptional R&D Tax Credit Support

The Acena Consulting Difference

Find out how our tax credit specialists help our clients grow and protect their business

Tax Credit Overview

Take a deeper dive into the qualifications needed to claim the R&D benefit

Services Provided

Leverage our full suite of specialty tax services to maximize overall credit