I had the pleasure of speaking to a client today that had a misconception about the research and development tax credit. There was a misinterpretation that only incremental increases in qualified expenses counted toward the Research & Development Credit calculation. I thought it would be appropriate to discuss this popular myth and the correct calculation.

I had the pleasure of speaking to a client today that had a misconception about the research and development tax credit. There was a misinterpretation that only incremental increases in qualified expenses counted toward the Research & Development Credit calculation. I thought it would be appropriate to discuss this popular myth and the correct calculation.

The Federal Research & Development tax credit has been part of the tax code since 1981. Over the last 30 years, this tax incentive has become more taxpayer friendly and more available to small business. Let’s look at just one of the many myths that surround the research tax credit and to discuss the truth behind the myth.

Myth: Only incremental increases in research expenses count toward the credit

Myth:

My client (to be honest, a company I am helping to understand the Research & Development tax credit that I hope will be a client) was under the impression that only the annual incremental increase in research expenses counted toward the Research & Development tax credit calculation. As a result, they had internally decided to pass on taking the credit this year for that reason. So, we walked through the calculation to help them understand that their interpretation of the regulations wasn’t on point.

Fact:

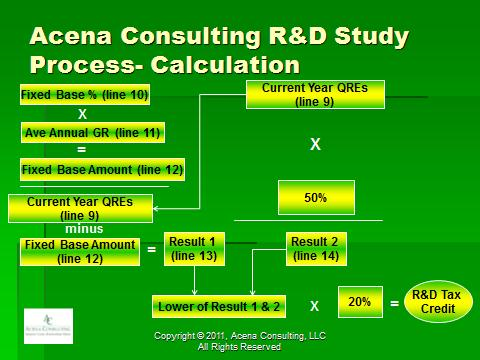

Qualified research expenses incurred during a tax year are analyzed in two ways to calculate the Federal research credit. First, we subtract the fixed base amount from current-year qualified research expenses (Result “A”). Second, we multiply current-year qualified research expenses by 50% (Result “B”). The two resulting numbers are compared, and the lower number is multiplied by 20% to calculate the current year tax credit.

The fixed base amount is calculated by multiplying the fixed base percentage times the average gross receipts from the prior four years.

As you can see, the calculation can be confusing.

Without going into a long discussion on the fixed base percentage, suffice to say it is intended to be an experience rate based on past qualified research expenses as a function of revenue. So, the amount that is used to calculate the current year tax credit depends on the fixed base percentage, average revenues from the prior four years and current-year qualified research expenses. In some cases, even if a company incurs less qualified research expenses, it can generate a current year tax credit.

Here is a graphical representation of the calculation:

Related Articles

10 Reasons not to take R&D tax credits (part 1)

10 Reasons not to take R&D tax credits (part 2)

Will An R&D Tax Credit Result In An Audit?

Free Resources

Click Here to Subscribe to Tax Incentives! Our Monthly Newsletter

R&D Tax Credits-More Information

What say you friends?

Are you comfortable that you are picking up all available expenses in your calculations?

Do you need more information on how to estimate your potential R&D tax credit?

Are you properly documenting your projects, hours and expenses?

Randy Eickhoff, CPA is President of Acena Consulting. With more than 20 years of tax and consulting experience, Randy focused on helping companies successfully document and secure tax incentives throughout the US. He has been a long-time speaker nationally as well as conducted numerous training sessions on Research & Development tax credits and other US tax incentives.