Congressional intent and IRS interpretation of new tax laws are often on opposite sides of the playing field. Most new legislation comes with complicated rules and regulations that can be misunderstood. Without constructive IRS guidance and case law, it can take years to get on the same page. In the meantime, the taxpayer and practitioner are left to navigate the muddied waters.

Some business entities are better prepared to capitalize on the confusion that follows new tax laws. Let's face it: larger companies tend to be more aggressive in their positioning, because, quite frankly, they can afford to be. These Fortune 500 corporations enter the process armed with teams of tax attorneys and lobbyists, moving forward at lightning pace to grab every dollar they can before subsequent clarity is offered. Likewise, smaller businesses often trend toward a more conservative approach to avoid penalization and fees due to vague language and process. As a result, startups and small- to mid-sized companies often leave money that's rightfully theirs on the table.

Research and Development Tax Credit: Underutilized by Smaller Businesses

The R&D tax credit stands out as a significant example of an incentive not utilized enough by small businesses due to complexities and uncertainties. First introduced in 1981 as part of the Economic Recovery Act, the Research and Development Tax Credit was established to support organizations dedicated to creating or further enhancing technology. To qualify, companies had to develop or improve a product, process, technique, formula, invention, or computer software. Pretty straightforward, right?

Yes and no.

Upon hearing the phrase "research and development," the average taxpayer conjures up images of a lab scientist in a white coat mixing up the latest antibiotic. And they wouldn't be that far off—this is primarily what the IRS initially proposed. In order for an activity to qualify, development had to expand the knowledge of others in a specific industry. Essentially, you needed to discover information that was new to the world. This "discovery test" limited incentive opportunity to big businesses with an already-established research and development department. Small companies were quickly relegated to the back of the R&D tax credit line, while industry giants like Apple and Amgen reaped the lion's share of benefits, maintaining the unbalanced status quo.

While the IRS stance on R&D was straightforward, Congressional intent was vague, causing many entrepreneurs to ask, "Did Congress mean only to reward those larger companies revolutionizing the world?" No one could seem to answer with certainty, instilling hope in small businesses across the country.

R&D Tax Credit Evolution

Flash forward to 2017, a time where companies in every vertical compete in a global marketplace. To remain competitive, U.S. corporations need to keep growing, innovating, and hiring technical employees, making R&D investment a must. After years of decline in our ability to compete with talent overseas for technical jobs, new focus (and pressure) was placed on the IRS to issue updated guidelines and policies. Final regulations, issued in January of 2004, omitted the requirement that research activities must achieve a new knowledge or discovery to the world—a major win for the many small businesses that are constantly fueling job growth and creation in our country.

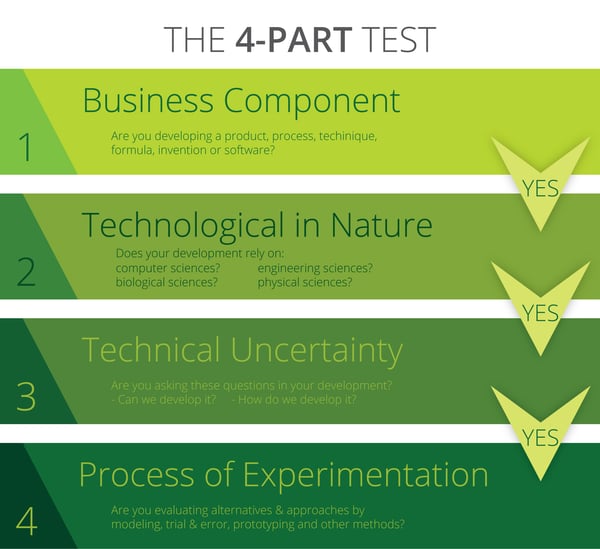

Take the Four-Part Test to See if Your Operations Qualify for the Innovation Tax Credit

The current R&D tax credit laws broaden the reach of eligibility for entrepreneurs running companies of every size and scope in a multitude of industries. Dig a little deeper and you may find that your day-to-day operational activities qualify your company as R&D. Note: To qualify, you must use U.S. labor in your development. Companies manufacturing, designing, or developing a product, process, technique, formula, invention, or software can run these research activities through a four-part test to determine eligibility:

Research Tax Credit: Qualifying Expenses

Understanding qualifying expenses can also help you optimize incentives on this tax credit. Some key considerations include:

- Amounts paid for wages, contractors, and supplies are the costs that drive the R&D tax credits.

- Historically, wages are the biggest R&D expense.

- Employee qualification is not based on title, education, or job description; instead, eligibility is based on involvement in qualified activities.

- Many businesses only track time for core engineering employees. However, direct supervisors often offer technical feedback and direction to engineers, qualifying their supervisory salaries for R&D tax credits as well.

- Eligible expenses also include those employees supporting the research activities.

- Qualified supplies relate to those supplies consumed while performing research activities. An example would be materials used to create a mold or prototype.

Contact Acena Consulting Today

Still have questions about research and development qualifications? Acena Consulting can help. For a general idea of your potential benefit, please click the link and enter your costs in the estimator. Or, contact our team today to discuss your operations with our experienced tax credit advisors.