Your company's research and development efforts require time, energy, capital, and a whole lot of ingenuity — and you still don't know with certainty if your end results will work. However, time spent developing new technologies or improving existing ones is critical for U.S. manufacturers to remain competitive in today's global marketplace. Congress seems to agree, continuously seeking to reward companies that pursue these activities through the Research and Development (R&D) Tax Credit.

R&D Tax Credits Qualifications: Get the Facts on the Process

Each year, thousands of small- to mid-sized businesses engage in eligible research and development operations. However, most companies lack the resources needed to determine which activities qualify their organization for the federal (and many times, state) innovation tax credits that decrease corporate tax burden and increase overall cash flow.

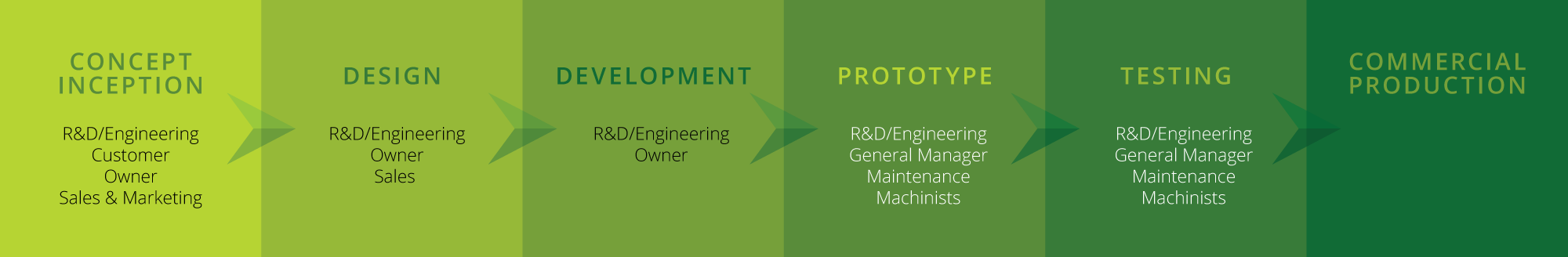

Do parts of your development process qualify for the R&D Tax Credit? Understanding the qualification process can help your business better document internal activities, which may directly result in higher generated claims and deductions. The six segments of the research tax credit process include:

1. Concept Inception

The first step in R&D qualification is simply to come up with an idea. Known as "Concept Inception" for tax purposes, this first phase starts the clock on your qualifying activities. At Acena Consulting, we define “Concept Inception” as the initial idea aimed at developing or improving a product, process, software, technique, formula, or invention (known as a business component in the tax world). Usually, these ideas are created by your engineers or developers, but could also come from you, (the business owner), customers, or even the sales and marketing teams.

2. Design

The next research and development phase typically involves generating a more detailed design of the idea to establish a concrete and detailed business component. This phase can include initial CAD drawings, process maps, and storyboards. The team typically involved in this process phase may be the same group that formulated the idea (R&D team, owner, or sales and marketing team), but it could also be an outside contractor.

3. Development

Following the design phase, a more detailed effort to identify materials, process, personnel, technology, and other variables are evaluated and chosen to build the initial prototype to follow. This phase helps to flush out poor designs by:

- Rethinking and refining the design

- Determining functionality

- Assessing manufacturability

This segment is typically conducted by the R&D team, the owner, and may also include an outside contractor.

After the design has been drawn, refined, and many of the uncertainties resolved, the project moves into the prototype phase. This project phase takes the concept and creates the physical product or determines the steps needed in a new process or technique. Questions around manufacturability, durability, and functionality can now be gauged before the prototype moves to the testing phase. The physical construction of the first prototype is typically performed by the R&D team, general manager, machinists, or even by maintenance.

5. Testing

Product testing follows the prototype phase. The testing segment focuses on several key prototype components, such as:

- Durability (determine how the materials used handle wear and tear, temperature changes, environmental extremes, etc.)

- Functionality (does prototype perform as expected?)

- Quality and specifications (does this meet our qualifications?)

Employees engaged in the testing process can include the R&D team, general manager, machinists, and maintenance.

6. Start of Commercial Production

Once the product is ready for commercial production, the R&D process is complete. First run products can be evaluated as part of the research and development progression to confirm a new or improved technology is functioning properly. After the company determines that everything works as it should, the R&D clock officially stops, and manufacturing begins.

Contact Acena Consulting Today

Ultimately, the costs of supplies, contract research, and wages of employees engaging in R&D activities throughout every phase of the process can qualify for the innovation tax credit. If you still have questions about your business's research and development qualifications, Acena Consulting can help. Contact our team of tax specialists today to determine your company's eligibility.