What is an R&D Tax Credit?

The Research and Development credit began in 1981 as the Research and Experimentation credit. Today, it remains a significant resource used by a variety of businesses to lower their federal and state taxes and increase cash flow. Since the adoption, the credit has been continuously evolving to encourage businesses to promote innovation and research-based growth. Despite the financial opportunities this credit provides, however, many qualified businesses don’t take advantage of it. According to the Credit Coalition, only about 35% of eligible companies file for these credits.

Benefits Overview:

The Research and Development tax credit is known to be one of the most significant incentives within the United States tax code because it a dollar-for-dollar credit against tax liabilities. While a business can incur expenses on a variety of research related items, the credit can include costs for supplies, wages, and contract research. The credit can be taken in any open tax year, which normally includes the last three years filed but can include more if the company had tax losses. Additionally, companies with insufficient tax liability will carry the credit forward to be used against future taxes.

Qualifications:

Despite the credit's evolution over time, many organizations still maintain the misconception that a research credit is only for companies conducting more traditional lab-style research. However, tax law changes have broadened the eligibility for companies in a variety of industries. Some of the more common eligible activities include:

· Design and engineering of new products

· Improvements on existing products

· Production or process enhancements

· Applications for patents and prototypes

· Testing of new materials or procedures.

· Software development (including internal use software)

· Trial and error experimentation

In order to qualify to receive the credit, companies must meet the criteria summarized with the Four Part Test. The IRS defines these tests as:

1. Elimination of Uncertainty (Section 174) Test: the expenditure must (1) be incurred in connection with the taxpayer’s trade or business, and (2) represent a research and development cost in the experimental or laboratory sense. Expenditures represent research and development costs in the experimental or laboratory sense if they are for activities intended to discover information that would eliminate uncertainty concerning the development or improvement of a product. Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the product or the appropriate design of the product.

2. Technical in Nature: In order to satisfy the technological in nature requirement for qualified research, the process of experimentation used to discover information must fundamentally rely on principles of the physical or biological sciences, engineering, or computer science. A taxpayer may employ existing technologies and may rely on existing principles of the physical or biological sciences, engineering, or computer science to satisfy this requirement.

3. Business Component Test: The taxpayer must intend to apply the information being discovered to develop a new or improved business component of the taxpayer. A business component is any product, process, computer software, technique, formula, or invention, which is to be held for sale, lease, license, or used in trade or business of the taxpayer.

4. Process of Experimentation Test: The final regulations clarify the requirement that a process of experimentation is a process designed to evaluate one or more alternatives to achieve a result, where the capability or the method of achieving that result or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

How Does the Credit Work?

There are two ways to generate the federal credit. The traditional method requires the taxpayer to exceed a base amount generated by multiplying the average gross receipts from the prior four years by a fixed base percentage (developed using one of several methods). This amount is this compared against 50% of the current year qualified expenditures. The lower of the two amounts is then used to calculate the current year federal credit.

The alternative method (conveniently named the Alternative Simplified Credit) provides a credit for taxpayers with qualified research expenses that exceed 50% of their average spending for the last 3 tax years. For example, if a company spends $10,000 annually in research expenses over the course of three years, they would multiply that by 50% and the result would be $5,000. Then, anything the company spends above $5,000 can be used to generate a federal tax credit.

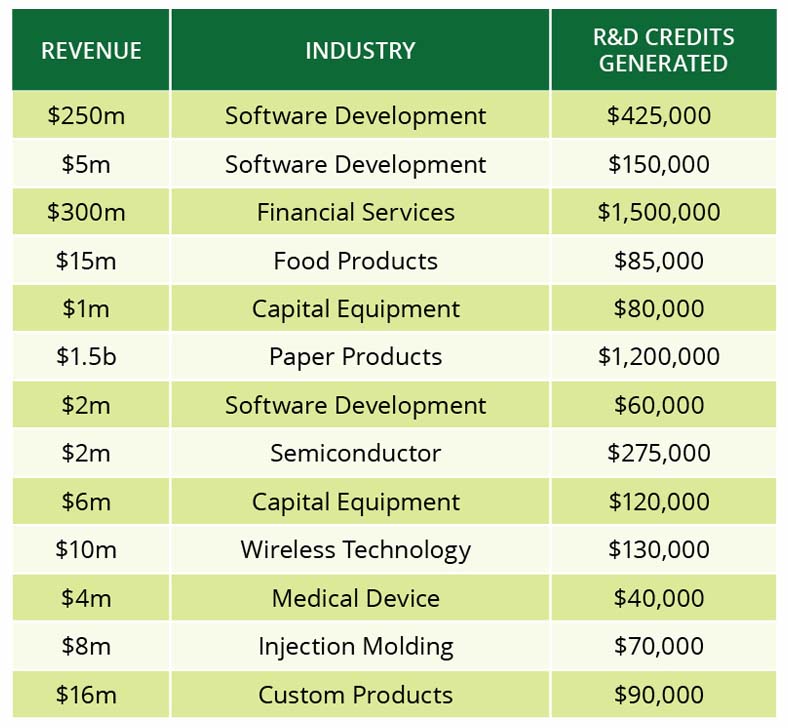

Acena’s Industry Successes

Starting The Process:

To see if you are a good candidate for the federal R&D credit, we encourage you to utilize our complimentary tax credit calculator. This simplistic tool is a great starting point to see if it worth your time and energy to move forward with the process of claiming any available research credits.